See what we’re saying

See why advisors love Planworth

Natasha Knox

ALAPHIA FINANCIAL Wellness

Practice

Free-for-service Planner

Clients

Employees, Retirees, Professionals

Services

Financial, Tax, Insurance, Estate

Since implementing Planworth, our client collaboration in the planning process has reached new heights. Planworth’s platform and tools have enhanced our ability to collaborate with clients and make planning more transparent and educational. And our clients find it empowering.

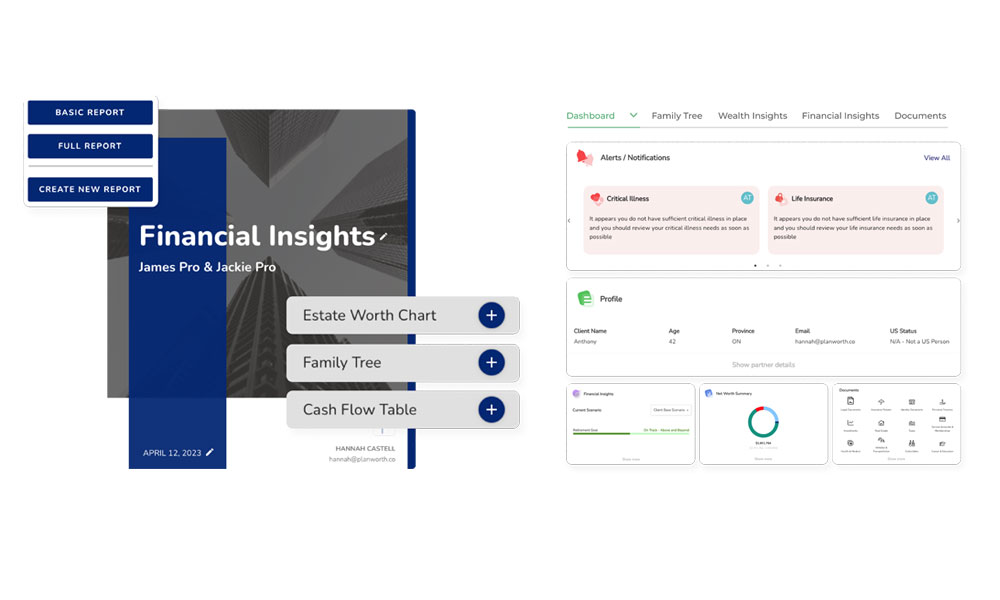

Favourite Features

- Scenario modeling is easy

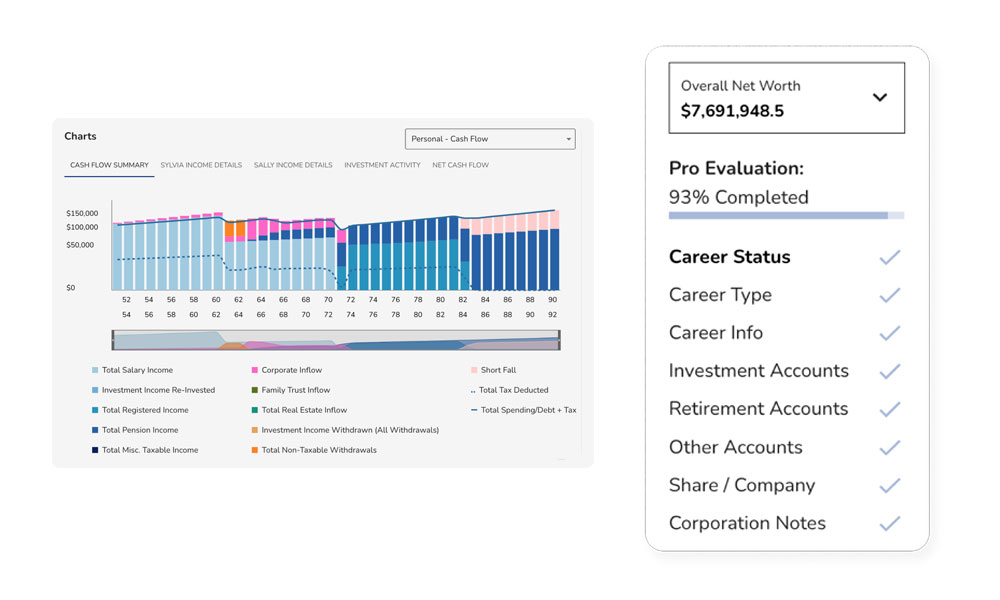

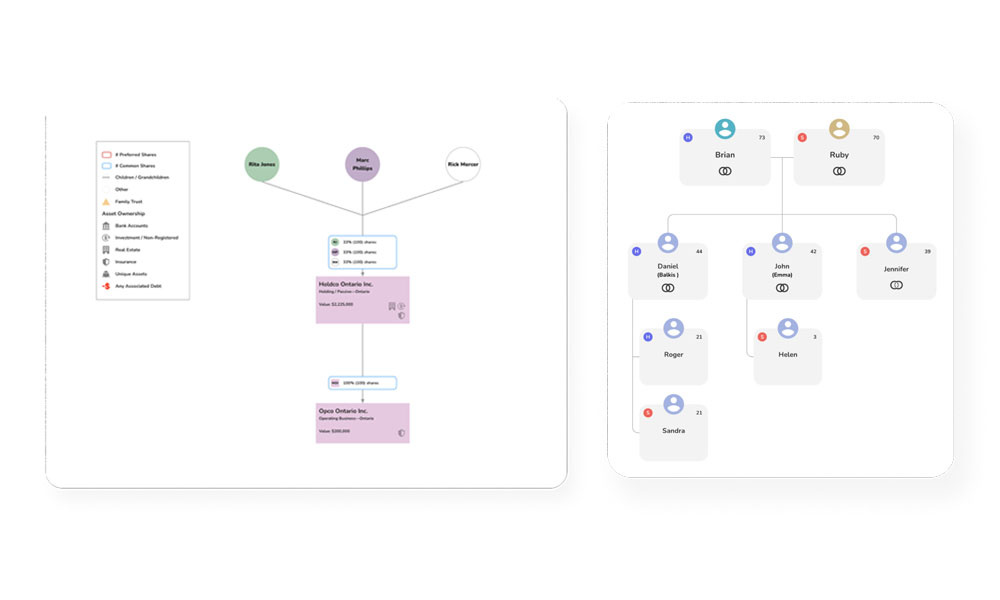

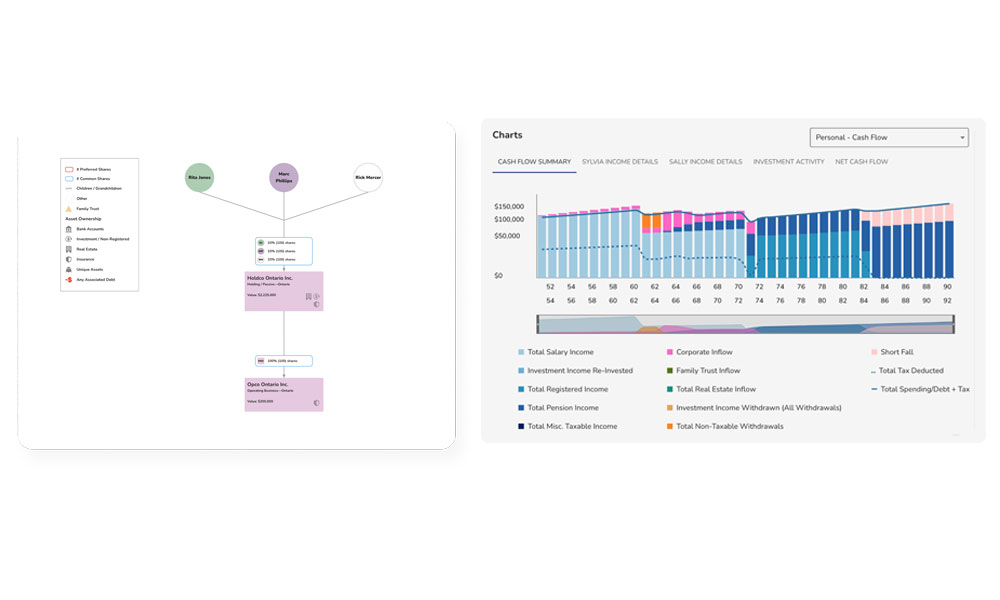

- Data visualization

- Report Wizard

- Customer Service

Tips & Timesavers

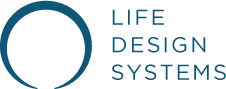

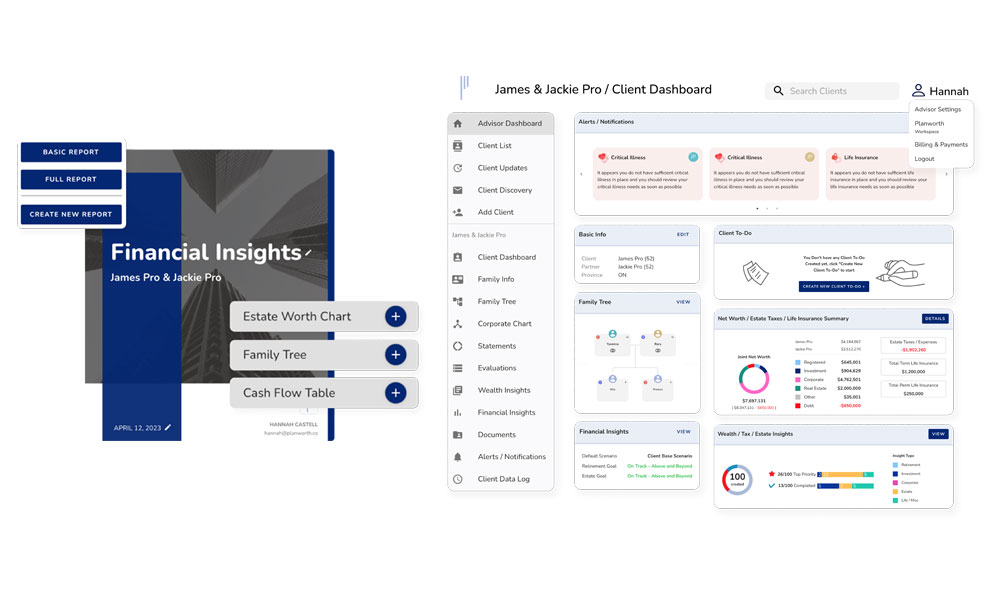

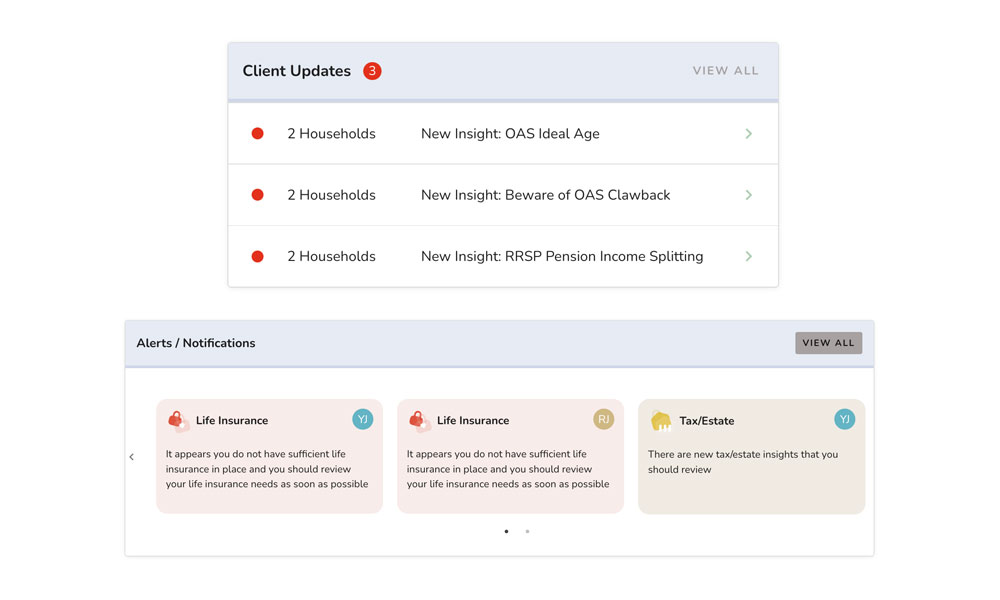

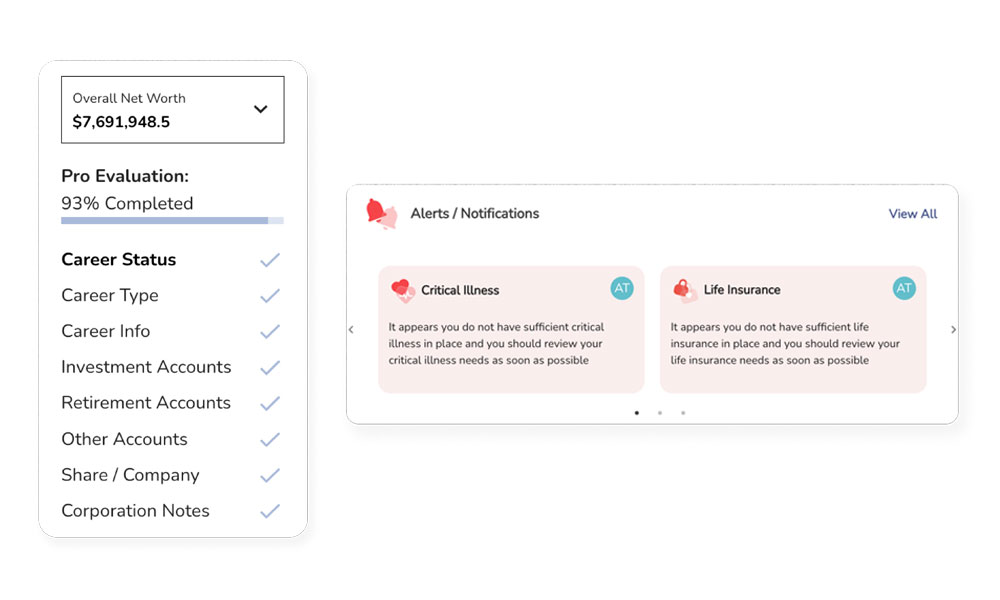

- Use the Clients Discovery Tool to get clients involved in the process.

- Use the Financial Insights Dashboard to conduct virtual collaborative planning sessions with client.

What I love about Planworth…

1. Collaboration

2. Understanding & Detail

3. Data Visualization

4. Customer Service

Jake Sheehan

Life Design Systems

Practice

Insurance Advisor

Clients

Owner-Managers, HNW

Services

Insurance, Tax, Estate

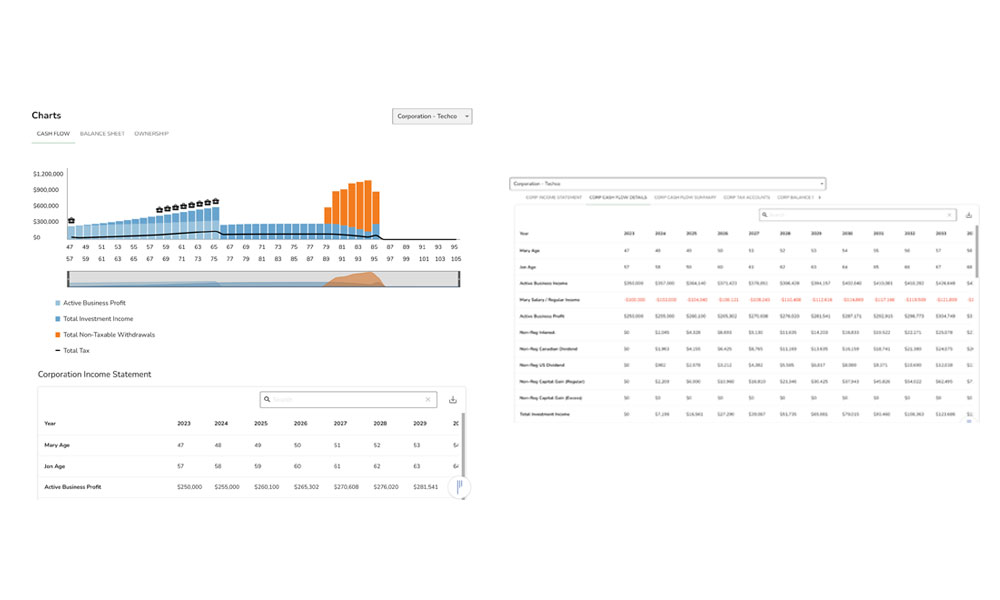

Planworth’s ability to handle complex corporate and trust structures, without any workarounds, sets the platform apart.

Favourite Features

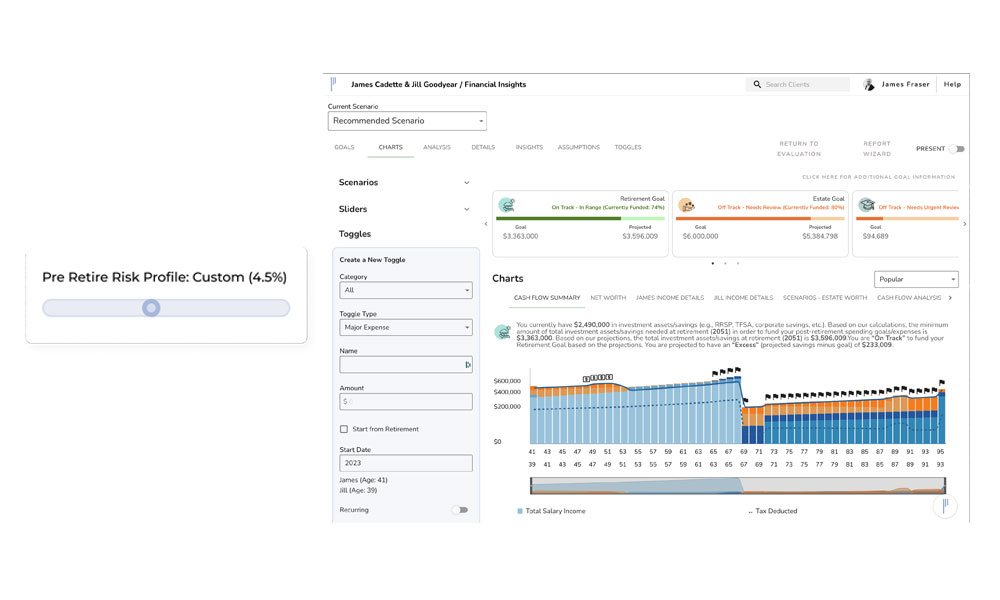

- Interactive, real-time planning tools

- Tax features and insights

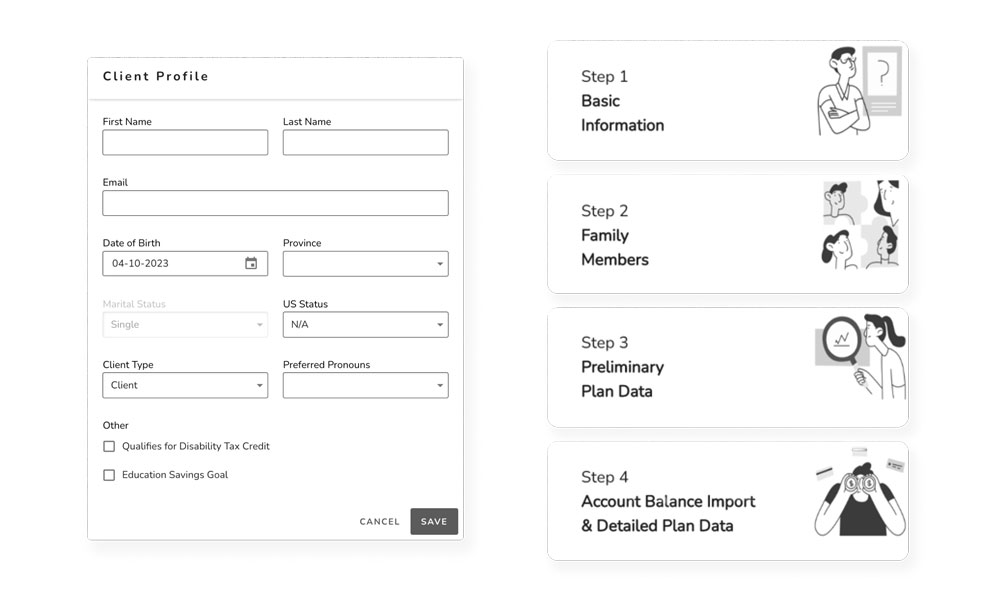

- Data intake workflow and capabilities

Tips & Timesavers

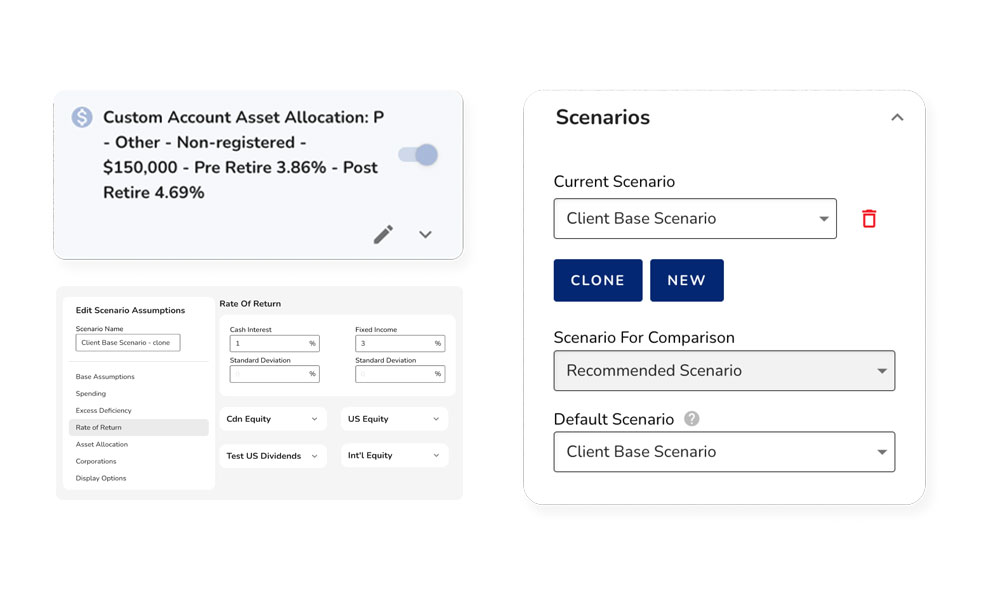

- Use Sliders and Toggles to tailor plans and model different strategies

- Quickly navigate between charts and tables to backup projections

What I love about Planworth…

1. Easy to Understand

2. Issue Spotting

3. Automatic Updates

4. Efficiency without Compromise

Bily Xiao

Mobius Planning

Practice

Fee-For-Service Planner

Clients

Employees, Retirees, Professionals

Services

Insurance, Tax, Estate, Financial

Planworth is stellar at complex scenario modeling and what-if analysis. Robust corporate planning is fully integrated – not just a feature in name only! Building a plan with Toggles is intuitive and easy.

Favourite Features

- Quick calculations

- Real cash flow planning for corporations

- Creating Toggles

Tips & Timesavers

- Use Toggles to quickly model what-ifs

- Create and compare scenarios to illustrate alternative strategies

What I love about Planworth…

1. Corporations

2. Quick Calculations

3. Complex Modelling

4. Scenarios

Craig Jensen

Insurance Advisor

Practice

Insurance Advisor

Clients

Owner-Managers, HNW

Services

Insurance, Tax, Estate

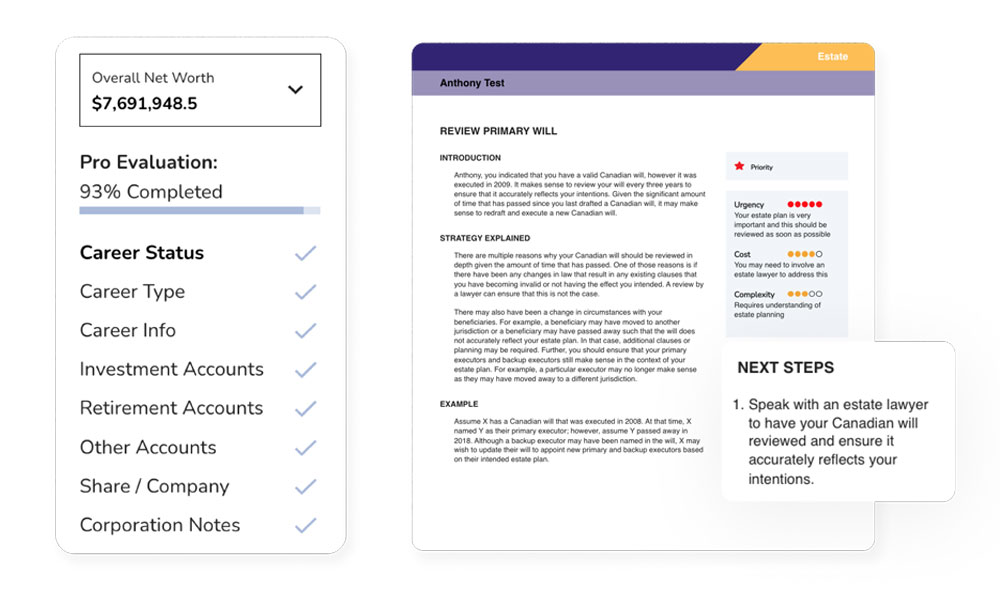

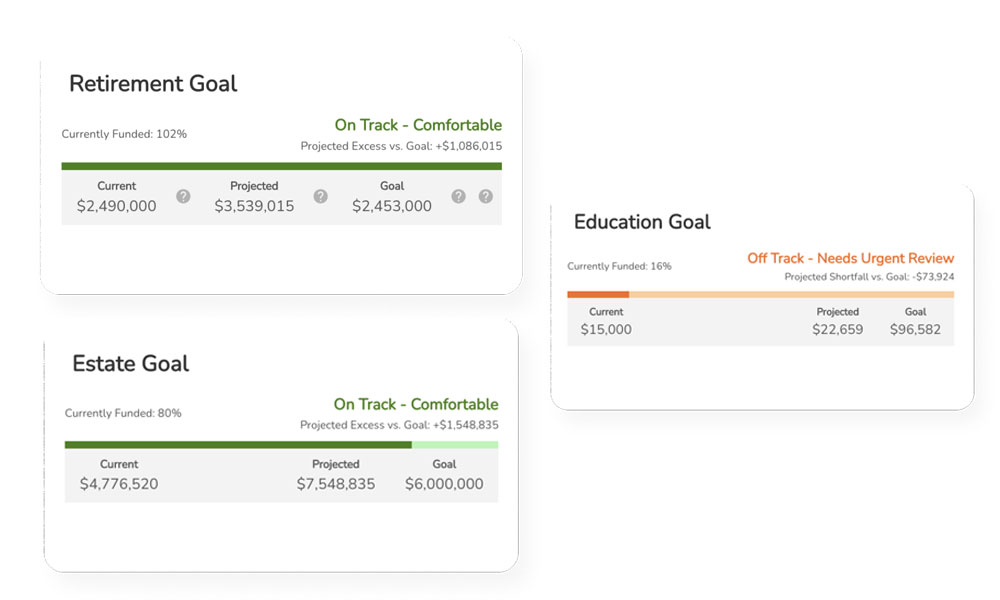

Each financial plan provided to our clients has unearthed value not discovered by previous retirement and estate planning. Planworth’s digitized form of needs analysis offers us a standard and thorough business practice that ensures our client needs are met and allows for our team’s growth.

Favourite Features

- Detailed scenario modelling

- Data visualization

- Report Wizard

- Financial/Wealth summaries

Tips & Timesavers

- Get clients involved in the process with the Client Discovery Tool

- Use the Financial Insights Dashboard for virtual collaborative planning sessions with clients

What I love about Planworth…

1. Cutting Edge Platform

2. Attention to Detail

3. Wealth Insights

4. Client Satisfaction & Growth